Before diving into Liability Insurance for Photographers, let’s enjoy this short real story.

A friend of mine, a wedding photographer, once had a terrible day. A guest knocked over his tripod, breaking his $5,000 camera. The couple was upset, and he even faced legal trouble. Since he had no insurance, he had to pay for everything himself. It nearly ended his career.

He’s not alone, 87% of photographers now get at least $1 million in liability insurance because many venues and clients require it.

Photography insurance isn’t just about rules; it’s about protecting your gear and business. Basic equipment coverage starts at just $6 a month, while bigger policies can cover up to $2 million per incident. Since photographers carry expensive gear worth $25,000 to $150,000, insurance is as important as a good camera.

In this guide, I’ll explain everything simply; how much photography liability insurance costs, what it covers, and how to pick the best plan. Let’s make sure you’re protected while doing what you love!

Table of Contents

Understanding Photography Liability Insurance Costs

Photography liability insurance costs vary by a lot. Annual premiums range from $200 to $1,020 for simple liability coverage. Here’s a breakdown of photography insurance pricing to help you understand these costs better.

Average cost ranges for different coverage levels

Monthly costs for vital coverage types follow an interesting pattern:

- General liability insurance averages $29 per month, though 90% of photographers pay less than $50 monthly

- Professional liability protection runs about $42 monthly

- Business owner’s policy (BOP) costs around $47 monthly

- Equipment coverage through inland marine insurance comes to $43 per month

Most photographers pick policies with $1 million per occurrence limits and $2 million combined limits. On top of that, commercial auto coverage, needed for moving equipment, averages $147 monthly.

Factors affecting premium rates

Your insurance costs depend on several elements:

Business Size and Structure Your photography business’s scale directly shapes premium rates. Multi-studio operations with several photographers naturally cost more than solo practitioners. Revenue plays a big part too – photographers making $125,000 or less often get more economical coverage options.

Location and Coverage Area Where you run your business affects insurance costs by a lot. Working in multiple locations or traveling for shoots might need extra coverage. Urban areas usually have higher premium rates than rural spots.

Equipment Value Your photography gear’s worth shapes inland marine insurance rates. Coverage options range from:

- $1,000 per item ($5,000 aggregate) at $55 annually

- Up to $15,000 per item ($75,000 aggregate) at $349 yearly

Risk Level and Claims History Photography ranks as a relatively low-risk profession. Notwithstanding that, your claims history and specific risk factors can change rates. To name just one example, see how wedding photographers might face different risk assessments than studio portrait photographers.

Cost comparison across insurance providers

Different insurance providers show notable variations in pricing:

Traditional Annual Policies

- Next Insurance: General liability starts at $21-$42 monthly

- Full Frame Insurance: Coverage begins at $12 monthly or $129 annually

- PPA Membership: Complete coverage costs $428 annually

Event-Specific Coverage Short-term needs can be met with event-specific policies:

- 1-3 day coverage starts at $59

- Extra photographer coverage costs $5 per person

Bundle Opportunities Insurance providers offer economical bundle options. A business owner’s policy (BOP) combines general liability with property coverage and saves 15-20% compared to separate policies. These packages cost $46 monthly on average and give complete protection at better rates.

The lowest price doesn’t always mean the best value. Look for insurers that offer:

Essential Coverage Types for Photographers

Professional photographers need resilient insurance protection that goes beyond simple coverage. Recent data shows nearly 85% of photography businesses choose multiple types of coverage to protect their operations properly.

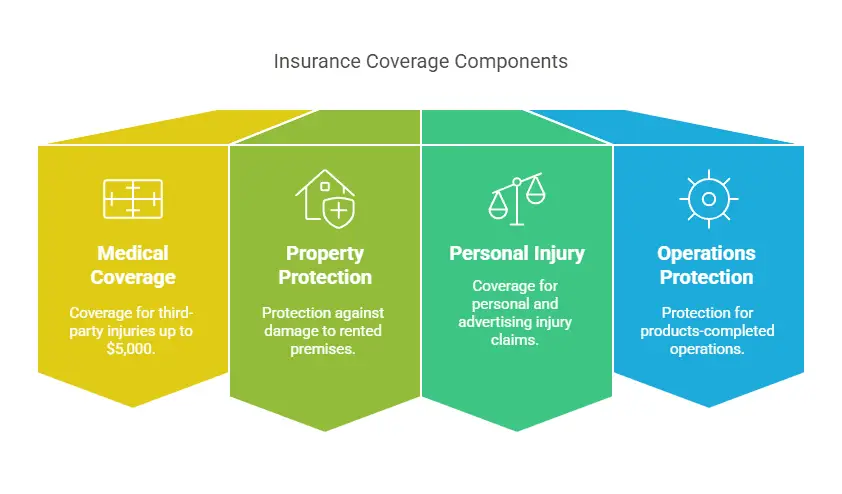

General liability coverage scope

General liability insurance is the lifeblood of photography business protection. This vital coverage protects against third-party bodily injuries and property damage claims that could happen during photoshoots. The policy has:

Most policies provide $2 million total coverage with $1 million per occurrence. Many venues and event organizers require photographers to carry general liability insurance before they can work on their premises.

Professional liability protection

Professional liability insurance, also called errors and omissions (E&O) coverage, deals with claims about service quality and professional mistakes. This coverage matters because:

- Memory Card Issues: Protection against lost or corrupted photo files

- Service Disputes: Coverage for claims about unsatisfactory work

- Missed Events: Financial protection if you can’t deliver promised services

- Professional Negligence: Defense against accusations of substandard quality

The policy covers legal expenses, including attorney’s fees, court costs, and potential settlements. This protection helps photographers who face client dissatisfaction or contractual disputes.

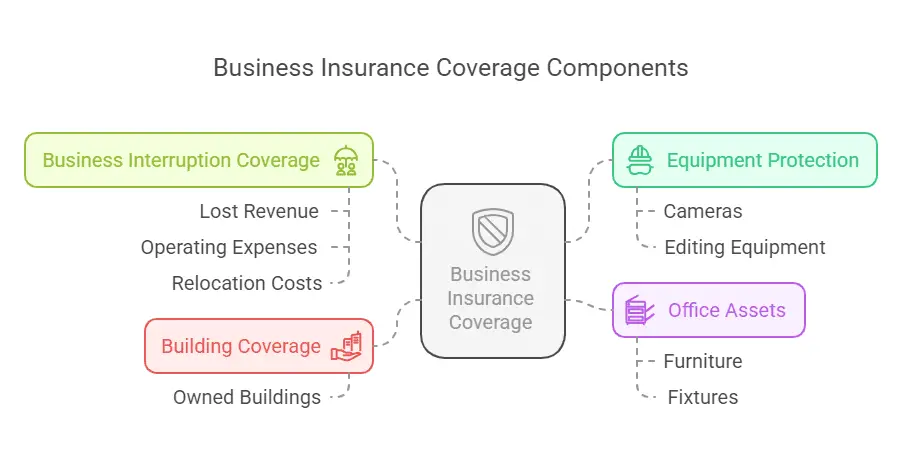

Equipment and property insurance

Professional photography equipment represents a big investment, so detailed property coverage matters significantly. Equipment insurance, also known as inland marine coverage, offers protection beyond your studio’s walls. Here’s what photographers should know about equipment coverage:

Coverage Scope:

- Protection for cameras, lenses, and lighting equipment

- Coverage for editing computers and software

- Protection during transit and on-location shoots

- Coverage against theft, fire, and natural disasters

Coverage Levels:

- Simple Coverage: Up to $15,000 in equipment protection with a $50 deductible for repairs

- Better Protection: $350 deductible for complete equipment loss

- Customizable Options: Coverage available for equipment valued between $1,000 to $75,000 total

A business owner’s policy (BOP) combines general liability with commercial property insurance. It gives detailed protection that includes:

Standard property insurance doesn’t cover equipment outside your studio. Inland marine insurance protects your gear during travel and on-location shoots.

The coverage structure uses a tiered approach. You can increase protection based on your equipment’s value and business needs. Photographers should check their equipment inventory carefully and think over potential risks when choosing coverage levels.

Real Insurance Claims in Photography

Photography businesses face insurance claims between $2,000 and $60,000 according to recent data. These numbers show why photographers just need complete coverage to protect their business. Let’s get into some real-life examples that clarify why liability insurance is crucial for photographers.

Common claim scenarios

Equipment damage and client disputes are the biggest problems in photography insurance claims. A $3,000 photography light ended up destroyed when the wind knocked it into a pool. Another photographer lost $2,500 when their zoom lens fell onto the floor from a shaky dresser.

Client-related claims usually happen because of:

Property damage has become a major concern too. One photographer had to pay after their tripod scratched an expensive floor. Another one faced demands after knocking down a valuable painting.

Settlement amounts

Latest settlement data shows some eye-opening claim costs:

Wedding Photography Claims:

- Lost photo reshoot compensation: $5,500 – $25,000

- Missed ceremony settlements: $7,500 – $20,000

- Late delivery penalties: $20,000 average

The Warner Brothers Records case with photographer George Dubose shows how big settlements can get. Courts recognized that original transparencies have unique value, especially for historical images that can’t be replaced. While photographers used to get $1,500 per lost negative, courts now look at:

A photographer received just $7,500 from a $60,000 settlement because of legal fees and international case complexities. This shows why you need to know your coverage limits and possible settlement outcomes.

Lessons learned

These ground-level claims are a great way to get insights for photographers looking for insurance protection:

Documentation Matters

- Claims are more successful with clear evidence of forced entry.

- Theft claims are approved more often when supported by a police report.

- Complete contracts help reduce losses from client disputes.

Risk Management Priorities

- Regular equipment checks lower the risk of accident-related claims.

- Proper cable management prevents injury claims.

- Backup systems minimize payouts for lost or corrupted photos.

Coverage Optimization

- Vehicle theft requires a specific policy for protection.

- Standard home insurance does not cover professional photography gear.

- Professional liability coverage is necessary for technical failures.

Photographers should build strong risk management strategies with complete insurance coverage. This means:

These real-life scenarios help photographers make smart choices about insurance coverage. The data shows that combining the right insurance with preventive steps gives the best protection against money losses.

Calculating Required Coverage Levels

Photography business owners need a systematic way to figure out their insurance coverage level. Statistics show that 43% face civil lawsuits at some point. Let’s see how you can calculate the right coverage for your photography business.

Risk assessment checklist

A full risk assessment looks at both hazards and their related risks. Here’s how you can assess your insurance needs:

Business Operations Assessment:

- Revenue check (coverage eligibility often caps at $125,000)

- Equipment inventory and valuation

- Number of employees and contractors

- Location-specific risk factors

Environmental Risk Factors:

- Studio setup safety measures

- On-location shooting hazards

- Weather-related concerns

- Equipment transportation risks

Client Interaction Analysis:

- Contract review procedures

- Communication protocols

- Service delivery standards

- Data management practices

These elements help you set the right coverage levels. To cite an instance, photographers who work in high-risk environments should get additional training in first aid and safety protocols.

Coverage calculator guide

The right coverage levels depend on these key metrics and calculations:

Base Coverage Requirements:

- General Liability: $1-2 million per occurrence

- Equipment Coverage: Value-based tiersSimple: $1,000 per item ($5,000 total)

- Standard: $5,000-$10,000 per item

- Premium: Up to $15,000 per item ($75,000 total)

Risk-Based Adjustments: Industry averages show typical claim amounts:

- Property damage claims: $30,000 average settlement

- Reputational harm: $50,000 typical claim value

- Client injury cases: $39,000 mean settlement

Coverage Optimization Strategy:

- Original Assessment

- Document all business activities

- List potential risks in order of likelihood

- Find out the potential financial effects

- Risk Control Measures

- Put preventive strategies in place

- Document safety protocols

- Keep up regular equipment checks

- Coverage Level Determination

- Calculate total asset value

- Look at client contract requirements

- Review venue insurance mandates

Cost-Benefit Analysis: Monthly premium costs match coverage levels:

- Simple Coverage: $11-25 Monthly

- Standard Protection: $25-50 Monthly

- Complete Coverage: $50+ monthly based on risk factors

Your coverage calculation should follow the S T O P method:

Businesses with fewer than five employees don’t legally need written risk assessments. However, keeping documentation helps with insurance purposes. You might want to adjust your coverage during peak wedding or event seasons when risk exposure goes up.

How to Lower Your Insurance Costs

Smart photographers can slash their insurance premiums by up to 25% with good planning and risk management. Here’s how to keep detailed coverage while managing your costs.

Bundle discount options

Insurance companies give great savings through policy bundling. You can get better rates by combining different types of coverage:

- Business Owner’s Policy (BOP): Merges general liability and property coverage and gives savings of up to 12%

- Equipment and Liability Bundle: Getting both coverages at once cuts down your overall package premiums

- Multi-Policy Discounts: You can save between 10-25% by combining three or more policies

Annual vs. Monthly Payments Yearly payments instead of monthly ones usually get you better rates. Plus, most insurers now let you change your coverage without penalties.

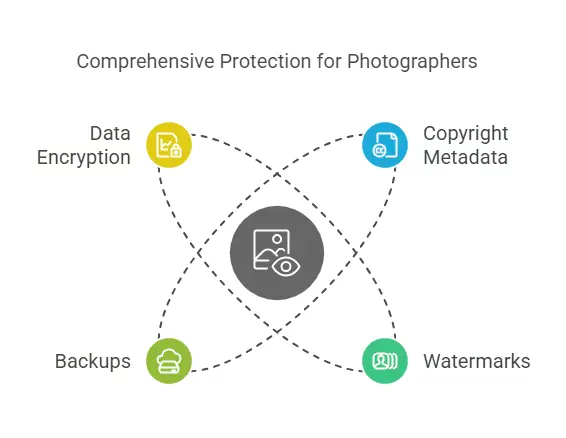

Risk management strategies

Good security measures protect your business and lower your insurance costs. Here are some proven ways to do this:

Physical Security Enhancements:

- Install professional security systems

- Turn storage spaces into secure rooms with deadbolts

- Buy high-quality locking travel cases

- Use GPS tracking devices for equipment

Location-Based Risk Control:

- Keep equipment in bonded facilities overnight

- Use cable locks during urban shoots

- Set up motion alarms for location shoots

Data Protection Measures:

- Regular backup system setup

- Encrypted client data storage

- Detailed workflow documentation

These safety steps show insurers you’re responsible and can lead to lower premiums. Plus, keeping a clean claims history through good risk management keeps future premiums down.

Policy optimization tips

Smart policy structure can cut insurance costs by a lot without losing quality coverage:

Coverage Level Optimization:

- Pick tiered equipment coverage based on actual value

- Match liability limits to venue needs

- Get short-term policies for occasional shoots

Budget-Friendly Options:

- Get quotes from multiple providers

- Ask for higher deductibles to lower premiums

- Look over and update coverage yearly

- Show all security measures to insurers

Venue-Specific Strategies:

- Add venues as additional insureds only when needed

- Get event-specific coverage for occasional shoots

- Look into freelancer policies for part-time work

Photography insurance brokers are often overlooked but valuable. These experts know industry risks well and can negotiate better rates. They also help ensure you pay only for the coverage you need while protecting your important assets.

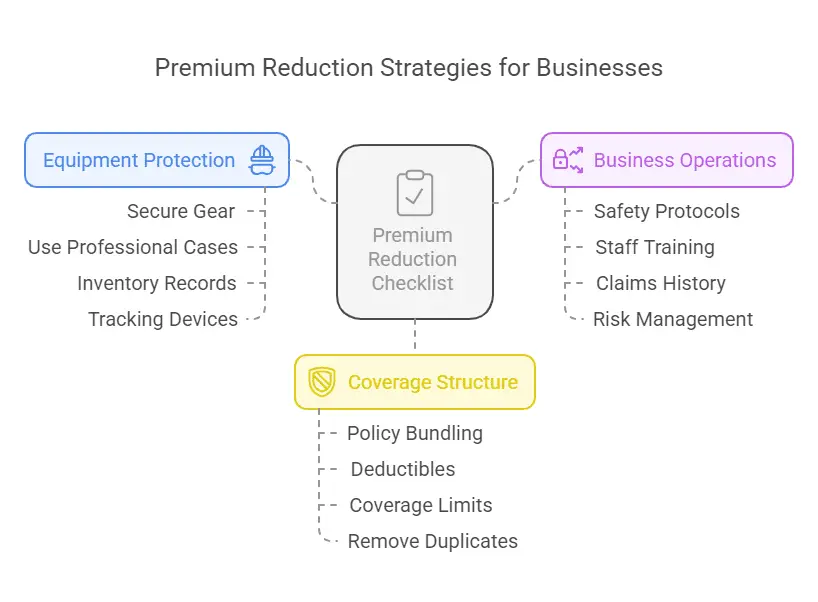

Premium Reduction Checklist:

These strategies help photographers keep detailed coverage at manageable costs when applied systematically. Note that the goal isn’t just to cut premiums but to get the best protection for your money. Working with experienced insurance providers who understand photography business needs ended up giving the most budget-friendly options.

Choosing the Right Insurance Provider

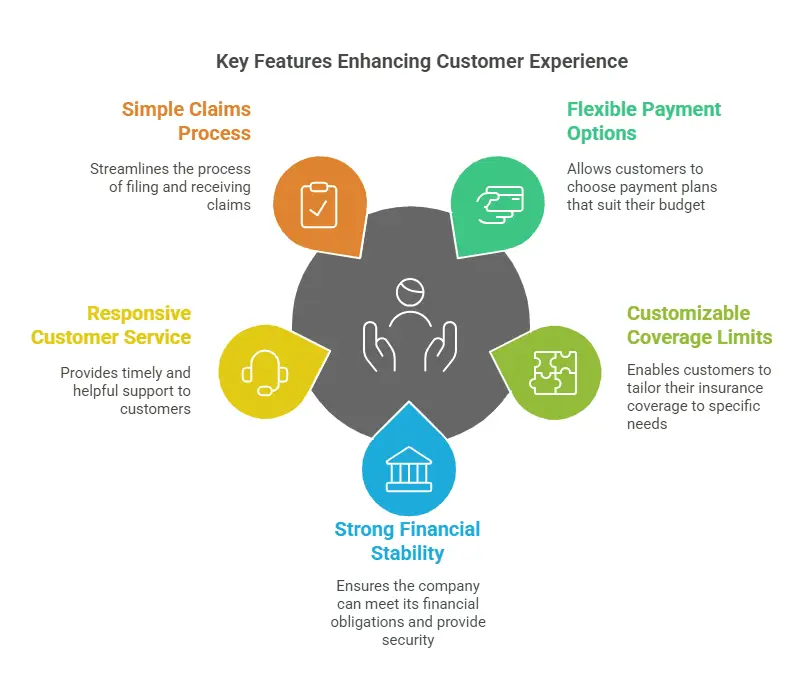

Photography insurance can be tricky. 43% of photographers struggle to find the right provider because there are so many options out there. Your choice of insurance partner will substantially affect your business’s financial health and future. Let’s take a closer look at what makes a good liability insurance provider and the warning signs you should watch out for.

Key evaluation criteria

Here are the most significant factors you should think over when picking an insurance provider:

- Industry Experience: Pick insurers who know the photography sector inside out. Companies that have spent years working with photographers will better understand what you need and give you the right advice.

- Coverage Customization: The best providers offer policies you can adjust to match your needs. This matters even more if you shoot in different locations or use specialized gear.

- Financial Stability: Check the insurer’s financial strength ratings from independent agencies like A.M. Best. A strong financial foundation means they’ll be there when you need to make a claim.

- Customer Service Quality: Good customer support is a great way to get help with urgent issues or complex claims. Look for providers that make filing claims simple.

- Coverage Limits: Make sure your provider offers high coverage allowances, particularly for expensive gear or risky shoots. Some insurers go up to $75,000 for equipment coverage.

- Pricing Structure: Price shouldn’t be your only deciding factor. Look for providers with tiered pricing that lines up with your business size and risk level.

- Policy Flexibility: The best insurers offer both annual coverage and event-specific policies. This works great for part-time photographers or those with seasonal work.

- Additional Benefits: Some providers throw in extras like legal advice, equipment rental coverage, or loss prevention resources. These perks can add real value to your insurance package.

- Claim Processing Efficiency: The insurer’s claim settlement process and turnaround times matter. Quick claims processing helps keep your business running smoothly.

- Policy Exclusions: Read the fine print about what’s not covered. Pay extra attention to rules about moving equipment or shooting in specific locations.

Red flags to watch for

Keep an eye out for these warning signs when checking out insurance providers:

- Lack of Transparency: Watch out for insurers who dodge questions about their policies or pricing. Hidden fees or unclear terms should raise red flags.

- Limited Industry Knowledge: Providers who don’t get the photography business might offer coverage that misses the mark.

- Excessive Exclusions: Every policy has exceptions, but too many restrictions could leave you exposed.

- Poor Reviews: A high number of negative reviews tells you something’s wrong. Good insurers should have way more happy customers than unhappy ones.

- High Deductibles: Lower premiums might look good, but sky-high deductibles could make it hard to file a claim when you need to.

- Inflexible Policies: Stay away from providers who won’t customize coverage or adapt to your changing business needs.

- Lack of Digital Tools: These days, insurers should offer user-friendly online platforms for managing policies and filing claims.

- Unrealistic Promises: If the coverage sounds too good to be true, especially at super low rates, it probably is.

- Pressure Tactics: Good insurers won’t push you to decide quickly. Take your time to compare options.

- Unclear Communication: If you can’t get straight answers now, imagine how hard it’ll be when you need help with a claim.

Make sure your provider has proper licenses and follows regulations. Some venues won’t let photographers work without proper insurance, so picking a legitimate insurance partner matters.

The right liability insurance provider will protect your photography business and help it grow. Take time to check each provider against these criteria and watch for warning signs. Your goal isn’t to find the cheapest option – it’s to get solid coverage that lets you focus on your work with peace of mind.

Conclusion

Photography liability insurance protects our businesses effectively, with costs ranging from $200 to $1,020 annually for simple coverage. Most photographers opt for a $1 million per-occurrence limit. These limits can change based on business size, location, and equipment value.

Coverage needs to go beyond simple liability protection for photographers who think ahead. Equipment insurance guards our valuable gear. Professional liability coverage shields against service-related claims. Claims can reach $60,000 or more in real-life cases, which shows how proper coverage pays for itself repeatedly.

Your insurance premiums could drop by up to 25% with strong risk management strategies. Policy bundling, yearly payments, and security measures help maintain resilient protection at manageable costs. A provider’s photography industry experience will give you tailored coverage that fits your unique needs perfectly.

Your photography business’s growth demands regular coverage reviews. Take time to assess current risks and compare providers. Pick a coverage that lines up with your specific needs. Insurance might look expensive now, but protecting your photography business against risks is nowhere near as costly as facing unexpected claims without proper coverage.

Frequently Asked Questions

What is the average cost of liability insurance for photographers?

Liability insurance for photographers typically costs between $200 to $1,020 annually for basic coverage. Most photographers opt for $1 million per occurrence limits, with costs varying based on factors like business size, location, and equipment value.

Why is liability insurance crucial for photographers?

Liability insurance protects photographers from potential financial losses due to accidents, property damage, or dissatisfied clients. It’s often required by venues and can cover legal fees and settlements, which can reach up to $60,000 or more in some cases.

What types of insurance coverage do photographers need?

Photographers typically need general liability insurance, professional liability (errors and omissions) coverage, and equipment insurance. Some may also benefit from a business owner’s policy (BOP) that combines general liability with property coverage.

How can photographers reduce their insurance costs?

Photographers can lower insurance costs by implementing risk management strategies, bundling policies, opting for annual payments, and enhancing security measures. These actions can potentially reduce premiums by up to 25%.

What should photographers look for when choosing an insurance provider?

When selecting an insurance provider, photographers should consider factors such as industry experience, coverage customization options, financial stability, customer service quality, and policy flexibility. It’s also important to watch out for red flags like lack of transparency or excessive policy exclusions.