Most appliance repair business insurance owners pay between $39 to $49 per month for insurance and think they’re well protected. The simple coverage has standard $1,000,000/$2,000,000 general liability protection. However, we’ve noticed significant gaps in typical policies that could put your business at risk.

The appliance repair market will grow by 8% by 2030. Traditional insurance policies haven’t evolved enough to handle new risks. Standard policies don’t cover crucial areas like smart appliance damages and cyber liability. These gaps could devastate an appliance repair business. Simple coverage remains necessary but doesn’t protect against today’s challenges that appliance repair professionals face.

Table of Contents

This piece will show you why your current insurance might leave you exposed and what changes you need to think over for 2025. You’ll learn about coverage gaps and discover ways to protect your business that work.

Common Insurance Gaps in Appliance Repair

Many appliance repair businesses only rely on simple general liability insurance and think it gives them full protection. But several critical coverage gaps could leave your business exposed to major financial risks.

Outdated coverage limits

Standard general liability policies usually offer coverage limits of $1 million per occurrence and $2 million total. These traditional limits might not be enough for modern repair scenarios. Most policies have deductibles from $500 to $2,500 that businesses need to pay before coverage kicks in. Equipment breakdown insurance often leaves out regular wear and tear and maintenance issues.

Missing smart appliance protection

Smart home technologies make appliance repair coverage more complex now. Regular policies often miss protection for sophisticated IoT-enabled appliances and their risks. Insurance providers haven’t kept their coverage terms current enough to handle damages linked to smart home systems and connected devices.

Modern appliances create valuable data about usage patterns and environmental conditions. Traditional insurance policies rarely cover potential losses or damages from this data collection and storage. Smart appliance repairs need specialized knowledge and tools, yet many standard policies don’t include these advanced repair needs.

Inadequate cyber liability coverage

The biggest gap shows up in cyber liability protection. Small and mid-sized appliance repair businesses face higher cybersecurity risks because they:

- Use external IT services

- Have limited IT resources

- Employ multiple technicians who each represent potential security risks

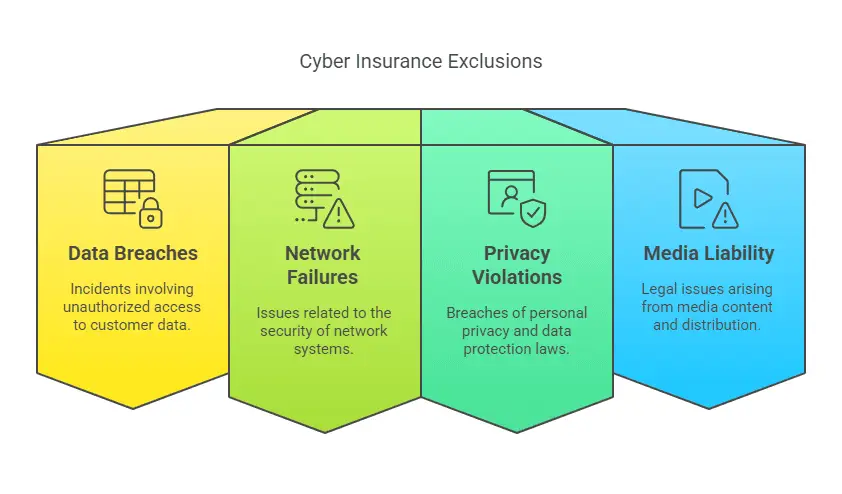

Simple business insurance policies don’t usually cover cyber-related incidents such as:

Social engineering attacks come with specific coverage limitations. The average cost of a cyber attack for small businesses runs up to $8,699.48. This gap becomes especially worrying when businesses work with commercial clients and access their internal systems.

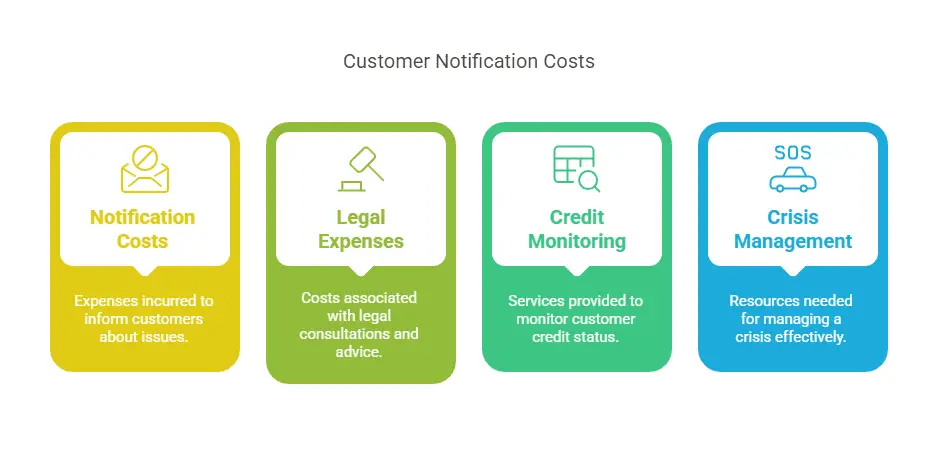

First-party cyber response coverage has become vital to cover:

- Services that detect breaches

- Customer notification requirements

- Credit monitoring services

- Crisis management

- Business interruption costs

Appliance repair businesses should look into specialized coverage options beyond standard policies. Working with experienced insurance providers who know modern appliance repair’s unique risks can help ensure full protection against both traditional and new threats.

Hidden Risks Not Covered by Standard Policies

Appliance repair businesses face several risks that regular insurance policies don’t cover well. These unseen threats can cause serious financial problems if you don’t protect your business properly.

Data breach exposure

The latest stats paint a worrying picture about data security – over 290 million individuals had their personal information exposed in data breaches last year. This risk becomes more serious for appliance repair businesses that work with smart appliances storing customer data.

Regular insurance policies don’t deal very well with everything in data breach response:

The situation becomes more concerning because only 48% of people who knew about their compromised information changed their passwords, suggesting poor security awareness. This makes appliance repair businesses attractive targets because they handle:

- Social Security numbers

- Personal health information

- Bank account details

- Credit card information

Data breaches cost more every year, with the global average reaching $4.50 million in 2023. So, appliance repair businesses need special cyber liability coverage that goes beyond standard policy limits.

Smart home system damages

Smart home technology keeps growing rapidly. Monitoring systems will grow by 33% over the next three years. This move toward smart technology creates new challenges because standard policies usually don’t cover:

- Damages to interconnected systems

- Liability for smart device malfunctions

- Data loss from connected appliances

Smart home devices collect detailed data about when people are home and how they use appliances. This information helps calculate risks better, but it also creates new liability issues that basic insurance policies can’t handle.

IoT devices connected to home systems create complex situations. Damage to one device can affect many others. Standard policies typically don’t cover:

- Damages from software malfunctions

- Network-related failures

- Remote access incidents

Smart home monitoring systems can detect several threats:

- Break-ins

- Fires

- Floods

- Gas leaks

These systems might fail during repair work, and regular policies might not cover the damage or liability claims. Insurance companies still try to update their coverage terms for these new risks.

Smart technology helps reduce break-ins, fires, and water damage by a lot. Appliance repair businesses need modern coverage that recognizes both the advantages and risks of working with these advanced systems.

Why Traditional Coverage Falls Short

Modern appliance repair businesses face major coverage gaps in their standard insurance policies. Customer expectations and repair technologies keep evolving, which exposes the limitations of traditional coverage.

Limited scope for modern repairs

Standard insurance packages cover conventional repair scenarios but don’t deal very well with today’s complex appliance servicing needs. Most policies won’t cover damages from normal wear-and-tear or poor maintenance. Insurance companies often reject claims related to:

- Pre-existing conditions

- Improper installations

- Insufficient maintenance records

- Mismatched systems

Technology-related exclusions

Traditional policies show major gaps when it comes to technological advances. Standard homeowners’ policies rarely cover mechanical or electrical breakdowns. Equipment breakdown insurance specifically excludes:

- Regular maintenance issues

- Gradual efficiency loss

- Cosmetic damages

- Rust and corrosion effects

Standard coverage overlooks everything in modern appliance repair work. Insurance providers often deny claims because businesses lack proper maintenance documentation. Repair businesses face unexpected costs when technical issues stem from software malfunctions or network failures.

Changing liability landscape

The liability environment has changed dramatically for appliance repair businesses. 40% of small business owners will likely face a property or general liability claim in the next decade. Standard policies don’t provide adequate coverage for:

- Professional mistakes (like incorrect dryer vent installations causing moisture damage)

- Workplace injuries during heavy appliance movement

- Property damage during installation procedures

Standard policies lack first-party cyber response coverage despite its growing importance. This creates problems as repair businesses work with sophisticated equipment that generates valuable usage data. Traditional coverage excludes protection against data breaches, network security failures, and privacy violations.

Insurance providers must adapt to meet these new challenges. Policies that were once enough now leave businesses exposed to modern risks. Repair businesses need complete coverage that addresses both traditional and contemporary hazards as appliance technologies advance. Businesses should look beyond standard coverage and find specialized protection that fits their specific operational needs.

Essential Coverage Updates for 2025

Insurance providers are changing their view of personal lines from negative to stable as we look toward 2025. This change brings significant updates that appliance repair businesses need to know about when they seek complete coverage.

New policy requirements

Insurance providers now need resiliency action plans before they’ll issue policies. Appliance repair businesses must meet these requirements that cover:

- Coverage limits that match current rebuild costs

- Telematics integration for business vehicles

- Better documentation systems for repairs

Most states call appliance repair specialists contractors, which makes general liability insurance and workers’ compensation a must. Your business needs active insurance coverage to:

- Start new projects

- Hire employees

- Drive company vehicles

- Protect owned or rented property

Better protection options

The insurance world keeps changing, and providers now have more coverage options that fit modern appliance repair needs. Business owners can protect themselves against:

Equipment and Tool Coverage A specialized inland marine insurance policy will protect your repair tools and equipment. This coverage goes beyond simple protection and handles:

- Flood damage to stored tools

- Equipment theft

- Accidental damage during transport

Professional Liability Expansion The updated professional liability insurance now handles incidents like dryer vents that weren’t attached properly and caused moisture damage. Your coverage has:

- Legal defense costs

- Property damage compensation

- Client financial loss protection

Complete Vehicle Protection Commercial auto insurance requirements have grown and now offer coverage up to $300,000 for:

- Vehicle damage during service calls

- Accidents while transporting appliances

- Parking-related incidents

Better Property Protection Business owner’s policies (BOP) now combine general liability with commercial property insurance at lower rates. These improved packages have:

- Coverage for owned or leased buildings

- Inventory protection

- Equipment safeguards

Monthly costs for appliance repair business insurance range from $39 to $49. These rates depend on:

- Services offered

- Equipment used

- Property ownership

- Revenue streams

- Employee count

Insurance markets need to stay flexible with their pricing and underwriting approaches to stay competitive. This flexibility will give appliance repair businesses coverage that matches their specific operational risks at affordable rates.

Your business should check its insurance coverage regularly to make sure it still works for your needs. Look at:

- The provider’s reputation and customer service quality

- Available coverage options

- Competitive pricing structures

- Claims processing efficiency

How to Evaluate Your Current Coverage

Your appliance repair business needs regular insurance coverage reviews. A well-planned approach will help you spot coverage gaps and give you full protection against new risks.

Risk assessment checklist

A detailed risk assessment will help you identify physical, location-based, and personnel-related exposures. Your business operations review should include:

- Building vulnerabilities (fire risks, hazardous materials)

- Location-specific threats (storms, natural disasters)

- Personnel access to sensitive information

- Technology dependencies

- Remote work considerations

Think over what might happen if your facility becomes unusable for long periods. Review risks when employees work at offsite locations or use personal vehicles for business tasks.

Coverage gap analysis

Start with a list of all your current policies. Look into these key coverage areas:

Property and Liability Protection

- General liability limits ($1 million per occurrence, $2 million combined)

- Errors & omissions coverage

- Directors’ & officers’ liability

- Employment practices protection

- Employee benefits liability

Specialized Coverage

- Cyber liability and data privacy

- Property and business interruption

- Fidelity & crime insurance

- Terrorism protection

- Communicable disease coverage

Take a close look at deductibles and self-insured retentions. Make sure all affiliates have proper coverage and see if new risks like climate change, pandemic diseases, or data security need extra protection.

Insurance audit steps

Premium audits will line up your coverage with actual risk exposure. Here’s how to do a detailed review:

- Prepare Financial Records

- Payroll documentation

- Sales records

- General ledgers

- Profit/loss statements

- Tax returns

- Review Business Operations

- Document employee roles

- Track subcontractor relationships

- Maintain safety protocols

- Update equipment inventories

- Evaluate Coverage Adequacy

- Compare current limits against actual needs

- Review policy exclusions

- Check claim history

- Spot coverage overlaps

Workers Compensation, General Liability, and Commercial Package policies usually need yearly premium audits. These reviews help match your estimated premium with actual business operations.

The best protection comes from keeping accurate records by employee and work type. Get Certificates of Liability Insurance from subcontractors and keep them easy to access. Meet with your insurance provider regularly to discuss changes in:

- Payroll figures

- Business operations

- Equipment acquisitions

- Service offerings

Note that poor coverage maintenance can lead to serious problems:

- Fines up to $10,000 per employee

- Criminal charges

- Full liability for workplace injuries

Regular reviews help your appliance repair business keep the right coverage and avoid extra costs. Partner with insurance providers who know the appliance repair industry to create policies that cover both traditional and new risks.

Conclusion

Today’s evolving market exposes gaps in standard appliance repair business insurance. Simple policies provide general liability protection. However, they don’t cover smart appliances, cyber threats, or data breaches effectively.

At the time the digital world reshapes the scene, businesses just need a fresh approach to insurance coverage. Traditional policies exclude vital areas like smart home system damages and cyber liability protection. These gaps raise concerns as repair costs and liability risks keep going up.

Appliance repair businesses should go beyond simple coverage. Regular insurance audits and risk assessments help spot issues before they get pricey. On top of that, it pays to stay updated with policy changes that protect against both old and new threats.

The appliance repair industry faces exciting opportunities and new challenges. Businesses must work with insurance providers who grasp these unique risks and offer complete coverage solutions. A full picture and strategic coverage updates will help appliance repair businesses build stronger protection to propel development in 2025 and beyond.

Frequently Asked Questions

How much does insurance typically cost for an appliance repair business?

Insurance costs for appliance repair businesses generally range from $39 to $49 per month. However, the exact price depends on factors like coverage limits, services offered, equipment used, property owned, revenue, and number of employees.

What are some common insurance gaps for appliance repair businesses?

Common insurance gaps include outdated coverage limits, lack of protection for smart appliances, inadequate cyber liability coverage, and exclusions for data breaches and smart home system damages. Many standard policies fail to address these modern risks.

Why might traditional insurance coverage be insufficient for appliance repair businesses?

Traditional coverage often falls short because it has a limited scope for modern repairs, contains technology-related exclusions, and doesn’t account for the changing liability landscape. It may not cover risks associated with smart appliances, software malfunctions, or data breaches.

What essential insurance updates should appliance repair businesses consider for 2025?

For 2025, businesses should consider enhanced protection options like specialized equipment and tool coverage, expanded professional liability insurance, comprehensive vehicle protection, and property protection enhancements. They should also ensure their policies meet new requirements such as resiliency action plans.

How can appliance repair businesses evaluate their current insurance coverage?

To evaluate current coverage, businesses should conduct a risk assessment, perform a coverage gap analysis, and complete an insurance audit. This process involves reviewing all policies, examining deductibles, assessing emerging risks, and comparing current limits against actual needs. Regular evaluations help ensure appropriate coverage while avoiding unnecessary expenses.