Customer satisfaction with home insurance claims has hit a five-year low, and a home insurance attorney’s role is more significant than ever. J.D. Power’s 2022 study reveals homeowners now deal with complex claims processes and face major communication delays from their insurance companies.

Most claim disputes get resolved without legal assistance. Legal representation becomes valuable for complex cases. Insurance companies process claims within 5 to 90 days, based on state laws. Professional legal guidance can substantially improve your settlement outcome, especially with expensive claims, complicated damage scenarios, or potential bad faith practices.

This piece explains the right time to seek legal representation, ways to choose the right attorney, and the claims process details. You’ll learn whether hiring a home insurance attorney fits your specific situation.

Table of Contents

Common Reasons Insurance Companies Deny Home Claims

A home insurance claim denial hits hard, especially when you’ve paid premiums year after year. Insurance companies deny claims for specific reasons. Understanding these reasons upfront helps build a stronger case.

Missed deadlines and paperwork errors

The claims process depends heavily on timing. Most insurance policies give homeowners one year from the damage date to submit claims. Notwithstanding that, some states follow a “notice-prejudice rule.” This rule stops insurance companies from denying claims just because of late filing. They must prove the delay affected their ability to break down the case.

Paperwork mistakes create obstacles during claims processing. Insurance companies inspect documentation with great care to find inconsistencies or gaps. Putting off repairs makes problems worse and costlier to fix.

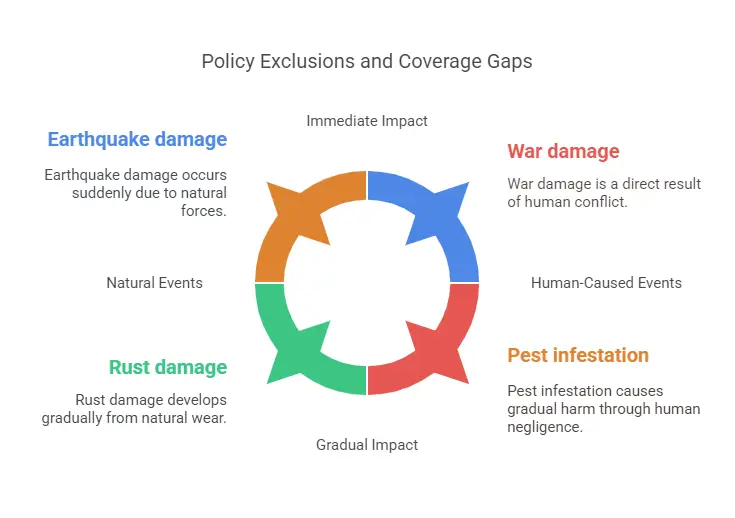

Policy exclusions and coverage gaps

Many property owners miss the specific exclusions and limits in standard homeowner’s insurance policies. Simple policies don’t cover:

On top of that, policies set strict dollar limits for valuable items. Most policies cap coverage at $1,000 for valuables. Owners of expensive jewelry, artwork, or collectibles need extra coverage through separate endorsements.

Water damage coverage presents another major gap. Standard policies leave out sewer backups and sump pump overflows. All but one of these flood claims happen outside high-risk areas, yet simple policies skip flood damage. A single inch of flood water can lead to $25,000 in damage.

Insufficient documentation

Strong documentation serves as the life-blood of successful insurance claims. Companies need solid evidence to verify losses and check coverage eligibility. This proof includes:

- Detailed photographs and videos of the damage

- Receipts for repairs and replacements

- Contractor estimates and inspection reports

- Witness statements where applicable

- Police reports (if relevant)

Insurance adjusters base their decisions largely on documentation details. Claims might face denial or lower settlements without enough proof. A detailed record of all insurance company communications helps your case. Keep names, contact details, and conversation dates.

A home insurance attorney adds real value in these situations. They know how to guide you through complex documentation needs, explain policy exclusions, and fight claim denials. To cite an instance, when an insurance company claims “insufficient documentation,” a skilled lawyer helps gather and present more evidence effectively.

Note that insurance companies must show how late notice hurt their case before denying claims based on timing. If you don’t agree with an adjuster’s findings, independent evaluations from qualified contractors or engineers provide unbiased third-party documentation.

Signs You Need a Home Insurance Attorney

The right moment to get legal help with your home insurance claim can affect your settlement by a lot. Here are three key situations where you’ll need a home insurance attorney.

Claim value exceeds $10,000

Claims worth more than $10,000 need extra care and special handling. Insurance companies inspect these claims carefully, which makes everything more complex. These high-value claims need more paperwork, and insurance companies might ask for specific inspections to verify repairs.

Claims over $10,000 that deal with mold or asbestos need an air clearance test report before you get your final payment. The same goes for sinkhole damage – you’ll need an engineer’s report to show the ground is stable.

Bad faith insurance practices

Insurance companies should handle claims fairly and quickly. But watch out for these warning signs that show you need legal help:

Delayed Response Patterns

- Insurance companies must respond to claims within 15 days and decide within 40 days

- Any claim that takes more than 60 days needs a closer look

- State laws give insurance companies 5 to 90 days to pay after accepting a claim

Suspicious Investigation Methods Insurance companies sometimes use questionable tactics:

- They ask for multiple inspections of damage they’ve already checked

- They keep asking for more documents one at a time instead of all at once

- They use experts who always side with insurance companies

Deceptive Communication Look out for these red flags:

- They twist policy terms or inspector findings

- They give unclear reasons for denying claims

- They write denials that mix up policy sections to avoid paying

Complex damage scenarios

Some situations need legal help because they’re just too complicated. You should talk to a lawyer when:

Multiple Cause Scenarios Damage often comes from several sources at once. Insurance companies might try to split these into separate claims with separate deductibles. A good lawyer makes sure this doesn’t happen unfairly.

Coverage Disputes You need legal help when:

- Your insurance company reads the policy wrong

- You disagree about how much damage is covered

- They don’t explain policy limits clearly

Environmental Hazards Cases with environmental issues need special handling:

- Mold claims need specific paperwork

- Asbestos damage needs expert proof

- Sinkhole claims must have professional engineering reports

A home insurance attorney proves most valuable because they know state insurance laws and can spot when companies break the rules. They also help you handle all the paperwork that comes with big claims.

Note that insurance companies must help you follow contract terms to get your benefits. If you face unusual delays, get unclear answers, or deal with complex damage, talking to a home insurance attorney might be your best move forward.

How to Find the Right home insurance lawyer

Selecting the right home insurance attorney is a big deal as it means that your claim’s success depends on several significant factors. The American Bar Association offers a complete directory tool that helps you find licensed attorneys near you. Many lawyers say they know insurance matters, but your claim’s outcome improves substantially with an attorney who specializes in homeowners insurance cases.

Experience requirements

Your home insurance attorney needs specialized knowledge in property insurance claims rather than general practice experience. These professionals must have:

- State bar admission and a Juris Doctor (JD) from an accredited law school

- Analytical and research abilities to handle complex insurance documentation

- Superior written and verbal communication skills that help in negotiations

- Deep understanding of federal, state, and local insurance laws

The quickest way to evaluate potential attorneys is to schedule initial consultations with several lawyers. Most attorneys provide free consultations to check case validity and see if they match your needs. During these meetings, focus on:

- Their success rate with cases like yours

- Knowledge of property claim evaluation methods

- Understanding of damage cause and origin

- Skills in building restoration and loss assessment

- Knowledge of insurance coverage details

Fee structures explained

Attorney fee arrangements are the foundations of selecting legal representation. Most home insurance attorneys work with these payment structures:

Contingency Fees Contingency fees are the most common arrangement where attorneys get a percentage of the final settlement. Here’s what you need to know:

- No money needed upfront

- Fees usually range from 25-33% of the recovery amount

- You pay only if you win

- Extra costs might apply whatever the outcome

Hourly Rates Some attorneys bill by the hour, mainly for smaller claims or consulting work. This budget-friendly option works better for:

- Claims needing limited legal help

- Cases requiring specific legal advice

- Situations that don’t need full representation

Fixed Fees Some routine legal matters qualify for fixed-fee arrangements. These cover:

- Standard documentation review

- Basic claim filing help

- Initial case evaluation

Here are other costs to think about:

- Court costs and filing fees

- Expert witness expenses

- Document preparation charges

- Investigation costs

- Travel expenses

Trustworthy attorneys provide written fee agreements that spell out all possible costs. These agreements must show:

- The exact percentage or rate charged

- Whether fees apply before or after expenses

- Extra costs you might face

- Payment terms and conditions

State laws require written fee agreements if predicted costs exceed $1,000. On top of that, many attorneys take cases on a “contingency fee” basis and collect payment only after winning your claim.

Ask about the lawyer’s policy on communication expenses, copying costs, and other administrative fees. Some firms include these in their base fee, while others bill them separately. You should also ask about potential conflicts of interest and how they handle multiple similar cases at once.

Preparing Your Case with an Attorney

A solid foundation for a successful home insurance claim starts with good preparation. Once you pick your legal representative, you need to understand what documents you’ll need and how long things might take to build a strong case.

Required documentation

Your position becomes stronger with the insurance company when you have the right documents. Here’s what you need:

- Photos and videos showing all damage

- A detailed list of damaged or lost items with their values

- Receipts for emergency repairs and temporary living expenses

- Police reports (for cases with theft or vandalism)

- Medical records (if anyone got hurt on the property)

- Proof of premium payments and policy documents

Insurance companies often ask for more than just simple documentation to prove your loss. You’ll need serial numbers for valuable items, old pictures showing how your property looked before, and what contractors think repairs will cost. On top of that, it helps to keep records of every conversation with insurance representatives to track your claim’s progress.

Timeline expectations

Knowing how long things usually take helps you plan better. Insurance companies must stick to these deadlines:

- Original claim acknowledgment within 15 days

- Decision making within 40 days

- Payment processing between 5 to 90 days after acceptance

Complex cases that involve multiple types of damage or environmental hazards might take longer. Sometimes insurance companies try to slow things down by asking for unnecessary paperwork or dragging out investigations without good reason. Your attorney can step in to make sure the company follows required timelines.

Initial consultation checklist

Your first meetings with your home insurance attorney are the foundations of your case. These items will help you get the most from your consultation:

Insurance Documentation

- Full insurance policy and plan documents

- Proof of premium payments

- Copies of previously filed claims

- All correspondence with your insurance company

Damage Evidence

- Detailed photo and video documentation

- Lists of items and their values

- Emergency repair receipts

- Contractor estimates

Communication Records

- Notes from talks with adjusters

- Emails and letters from insurance representatives

- Names and contact info of everyone involved

Your attorney will look at these materials to get a full picture of your case’s strength and create an effective strategy. You should keep organized records of all future communications and expenses throughout the legal process.

Claims worth more than $10,000 are a big deal as it means that insurance companies usually want extra documentation and specific inspections. You might need air clearance test reports for environmental hazards or engineering reports for structural damages.

Note that you should write down everything about your talks with adjusters, including dates, times, and what was said. These details are a great way to get ahead if disputes come up about delays or denied coverage. Keep receipts for any temporary fixes or alternative living arrangements since your policy often covers these costs.

Team up with your attorney to create a clear timeline for sending documents and following up. This approach prevents delays and gives you better leverage during negotiations. Keep copies of everything you submit and track all your claim-related expenses carefully.

Working with Your Home Insurance Lawyer

A productive partnership with your home insurance attorney needs clear communication and understanding of the legal process. Most attorneys work on contingency fees and get paid only after winning your case. This means both parties share the same goal of achieving a favorable outcome.

Communication best practices

Clear communication is the life-blood of successful claim resolution with your home insurance attorney. These practices are vital:

Documentation and Response Time

- Keep detailed records of all conversations

- Respond quickly to attorney requests

- Track important dates and deadlines

- Keep organized files of all claim-related documents

A well-laid-out communication framework prevents misunderstandings and speeds up the claims process. Attorneys usually set their preferred channels of communication early. They outline when each method works best:

- Regular email updates

- Scheduled phone consultations

- In-person meetings for complex discussions

- Secure document sharing platforms

Active Listening and Clarity Your attorney should use active listening skills to understand your concerns and circumstances better. You should:

- Ask questions when explanations aren’t clear

- Request simpler versions of complex legal terms

- Confirm your understanding of important points

- Share relevant information quickly

Understanding legal strategy

Home insurance attorneys use specific strategies to protect your interests during the claims process. They handle several key aspects:

Case Development Your attorney will:

- Research applicable federal, state, and local laws

- Create defense strategies through legal research

- Draft necessary legal documents

- Perform coverage audits

Negotiation Approach Skilled attorneys act as negotiators who want to achieve favorable settlements without court intervention. They focus on:

- Evaluating claim specifics

- Looking at insurance policies in detail

- Determining the best course of action

- Providing objective, clear-headed advice

Legal Documentation Your attorney manages important paperwork, including:

- Coverage opinions

- Legal briefs

- Motions and pleadings

- Case-related correspondence

Your attorney should be transparent about:

- Case progress and developments

- Potential challenges and solutions

- Timeline expectations

- Settlement possibilities

Note that attorneys cannot guarantee specific outcomes but can present your case more effectively and challenge unjust claim denials. Their expertise in handling complex insurance policies and legal issues often prevents mistakes that could reduce your compensation.

Your attorney should demonstrate:

- Deep knowledge of insurance law

- Experience with similar cases

- Strong analytical abilities

- Superior organizational skills

A strong foundation for successful claim resolution comes from good communication and understanding your attorney’s strategy. This partnership thrives when both parties maintain open dialog and share clear goals and expectations.

Cost vs. Benefit of Hiring an Attorney

Many homeowners struggle to decide if hiring a home insurance attorney is worth the cost. Without doubt, you’ll need to pay for legal help, but the extra money you might get from your settlement could make it worthwhile. Let’s explore deeply into what it costs to hire a lawyer for homeowners insurance claims and see how this might affect your final compensation.

Average attorney fees

The cost of a home insurance attorney depends on several things, like how complex your case is and what type of payment plan you choose. Here’s a simple breakdown of common fee arrangements:

Contingency Fees Most home insurance attorneys work on a contingency basis, which means they get paid only if they win your case. This setup gives you several benefits:

- No upfront costs for legal representation

- Attorneys want to get you the highest possible settlement

- You pay nothing if the case fails

The standard contingency fees are 25% to 40% of what you finally receive. To name just one example, if your attorney gets you $100,000, their fee might be $25,000 to $40,000, based on your agreement.

Hourly Rates Some attorneys bill by the hour, especially for smaller claims or advice. Recent data shows:

- Average hourly rate for lawyers in Louisiana: $245

- Range of hourly rates: $153 to $400

- Average hourly rate for insurance-focused lawyers: $171

Remember that hourly billing adds up fast, especially in complex cases that take months to resolve.

Fixed Fees Some attorneys offer fixed-fee packages for simple legal matters. These might include:

- Initial case evaluations

- Basic claim filing assistance

- Standard documentation review

Whatever the fee structure, good attorneys give you written agreements that spell out all possible costs. These agreements clearly show:

- Exact percentages or rates charged

- Whether fees apply before or after expense deduction

- Additional costs you might face

- Payment terms and conditions

State laws require written fee agreements if expected costs go above $1,000.

Potential settlement increases

The cost of an attorney might seem high, but the extra money you could get often makes it worth it. These statistics tell the story:

- People with lawyers get 3 to 4 times more money than those who handle claims by themselves

- The Texas Department of Insurance found that having legal support increases property insurance claim payments by 308% on average

These numbers show how much difference a lawyer can make in your final settlement. Home insurance attorneys help you get more money because they:

- Expertise in Claim Valuation: They know how to calculate all your damages, including future costs like medical expenses or lost income.

- Negotiation Skills: They know how to deal with insurance companies that try to pay less.

- Access to Expert Resources: They can bring in specialists like doctors or economists to make your case stronger.

- Threat of Litigation: Insurance companies often offer more money just because they want to avoid going to court.

- Understanding of Policy Nuances: They can find coverage options you might miss, which could increase your claim value.

Insurance companies take people with lawyers more seriously. They know they can’t use their usual tactics to reduce payments.

Lawyers usually take their percentage from the extra money they get you, not the initial offer. Here’s how it works:

- Initial insurance offer: $15,000

- Final settlement with attorney: $60,000

- Attorney’s fee comes from the extra $45,000, not the full $60,000

This setup means you’ll still come out ahead after paying your lawyer.

Think about these points too:

- Complexity of Your Claim: Simple claims might not need a lawyer. But complex cases with multiple issues or disputes are a great way to get legal help.

- Time and Stress Savings: Dealing with insurance claims takes time and causes stress. A lawyer handles the complicated parts while you focus on getting back to normal.

- Long-term Financial Impact: A good lawyer helps you get money for future expenses you might not think about.

- Protection Against Bad Faith Practices: If your insurance company isn’t playing fair, a lawyer can help you get extra compensation beyond your policy limits.

The decision to hire a home insurance attorney depends on your specific case. Claims over $10,000 or complex situations will give a better outcome with legal help. A lawyer’s expertise increases your chances of fair compensation and helps you handle the claims process better.

Conclusion

Legal guidance has become vital for homeowners as home insurance claims grow more complex. Not every claim needs an attorney, but expert help proves essential when claims exceed $10,000, involve bad faith practices, or present complex damage scenarios.

Claimants who hire legal representation receive three to four times more compensation than those who handle claims on their own. On top of that, attorneys offer vital expertise in policy interpretation, negotiation skills, and access to expert resources that shape settlement outcomes.

A smart first step is to schedule free consultations with qualified attorneys. These meetings help you evaluate your case’s strength and determine if legal representation makes financial sense. Most home insurance attorneys operate on contingency fees – you only pay when they win your case.

The right legal partner can direct you through complex documentation, fight unjust denials, and secure fair compensation. This lets you focus on rebuilding after property damage. Legal fees might look high at first, but increased settlements often make this investment worthwhile.

Frequently Asked Questions

When should I consider hiring a home insurance attorney?

You should consider hiring a home insurance attorney if your claim exceeds $10,000, you suspect bad faith practices by your insurance company, or you’re dealing with complex damage scenarios. Legal representation is also advisable if you’re facing significant delays, unclear explanations, or if your claim has been denied.

How much does a home insurance attorney typically cost?

Most home insurance attorneys work on a contingency fee basis, usually charging 25% to 40% of the final settlement amount. This means you only pay if they win your case. Some attorneys may charge hourly rates or fixed fees for specific services, but always request a written fee agreement detailing all potential costs.

What documentation do I need to prepare for my home insurance claim?

Essential documentation includes photos and videos of the damage, a detailed inventory of damaged items, receipts for repairs and temporary living expenses, police reports (if applicable), and your insurance policy documents. For claims over $10,000, you may need additional documentation such as air clearance test reports or engineering assessments.

How long does the home insurance claim process usually take?

Insurance companies typically must acknowledge claims within 15 days and make decisions within 40 days. Payment processing can take between 5 to 90 days after acceptance. However, complex cases may require additional time. If your claim process extends beyond 60 days without clear reasons, it may be worth consulting an attorney.

Is hiring a home insurance attorney worth the cost?

In many cases, yes. Studies show that claimants with legal representation often receive 3 to 4 times more compensation than those handling claims independently. Attorneys bring expertise in policy interpretation, negotiation skills, and access to expert resources that can significantly impact settlement outcomes, especially for complex or high-value claims.